Financial Software Development

Modern financial software development is a complex and ever-evolving field that requires software developers and testers to be well-versed in the intricacies of the financial and banking industries. Developing software for financial institutions comes with its own unique set of challenges that can often make the process more difficult or complicated than traditional software development. From stringent regulatory compliance requirements to complex security measures, developers and testers must navigate a web of factors to ensure their software is both reliable and secure.

Challenges

Financial service systems present unique challenges for software developers and testers. Regulators are highly concerned about ensuring the accuracy and traceability of the software development process. When developing financial software, it is crucial to have controls, processes, and technologies in place to manage changes to the system, as well as ensuring it meets regulatory requirements.

The primary challenges that software developers face when building financial software for banks and other institutions are:

- Regulatory compliance

- Traceability

- Security and privacy

- Transaction processing

- Complex algorithms

- Speed and agility

- Data interoperability

Keep reading to learn more about each challenge and how tools like SpiraTest and SpiraTeam can help.

Regulatory compliance

Developing and testing software for financial and banking companies goes beyond the usual testing requirements of functional, performance, and vulnerability testing. In addition to these requirements, financial systems must comply with a constantly evolving set of regulations from organizations such as the SEC, ECB, and CFPB as well as international standards such as ISO 20022 for payments.

Since 2001, there have been numerous changes to financial laws, such as Sarbanes-Oxley, Basel II, Dodd-Franks, and FATCA. Each of these changes requires software developers and testers to adjust their test plans, validation procedures, and system requirements accordingly. This adds an additional layer of complexity to financial software development, making it crucial for software development teams to have the right tools and processes in place to navigate this regulatory landscape.

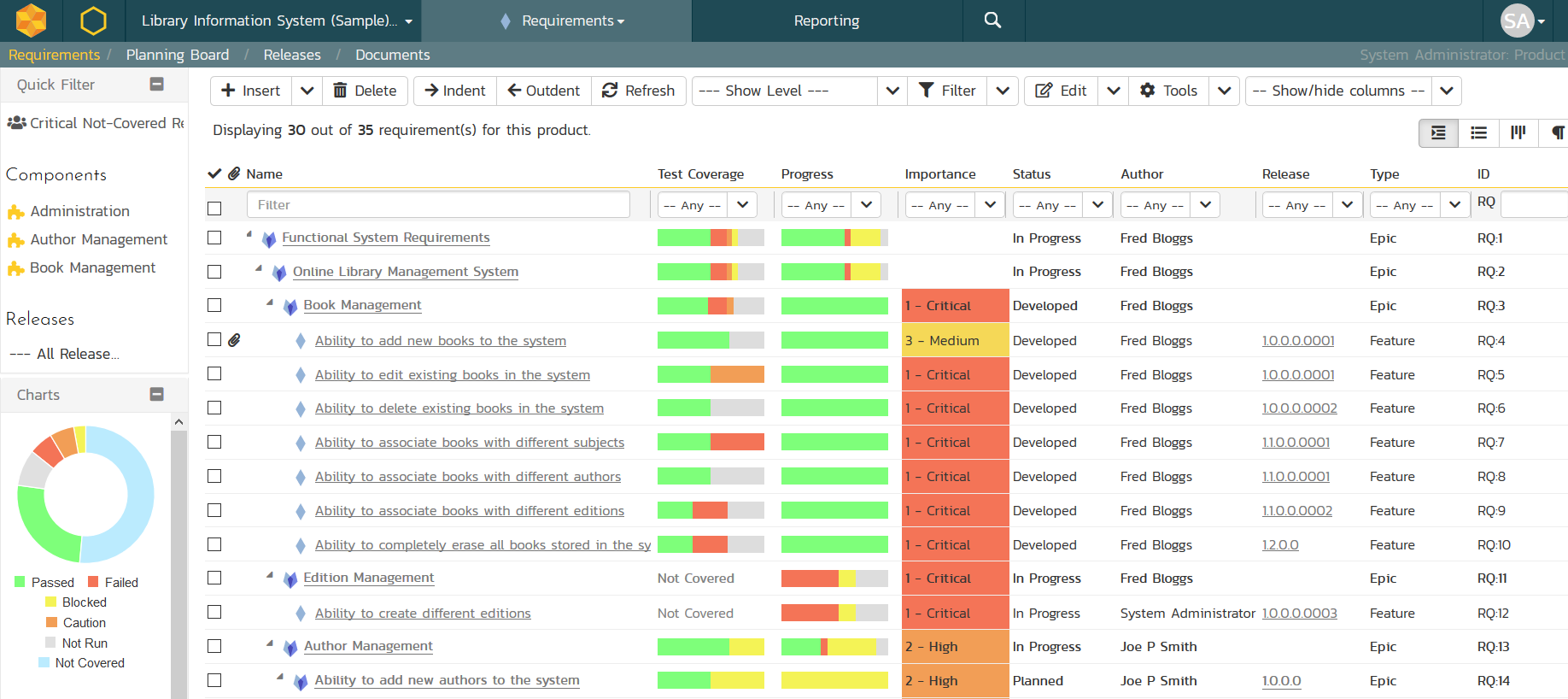

SpiraTest provides the premier solution for managing all of your requirements, test cases, and validation scenarios in a central, easy-to-manage repository. With SpiraTest, you can stay on top of the changes and manage them rather than them managing you!

Overarching policies & requirements

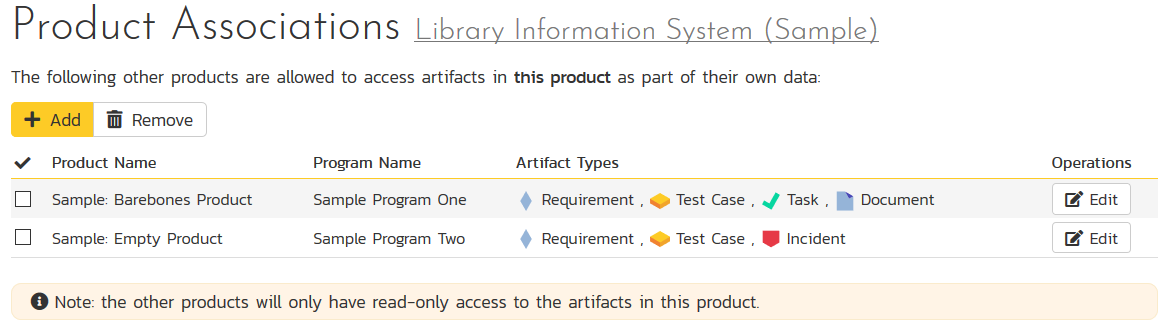

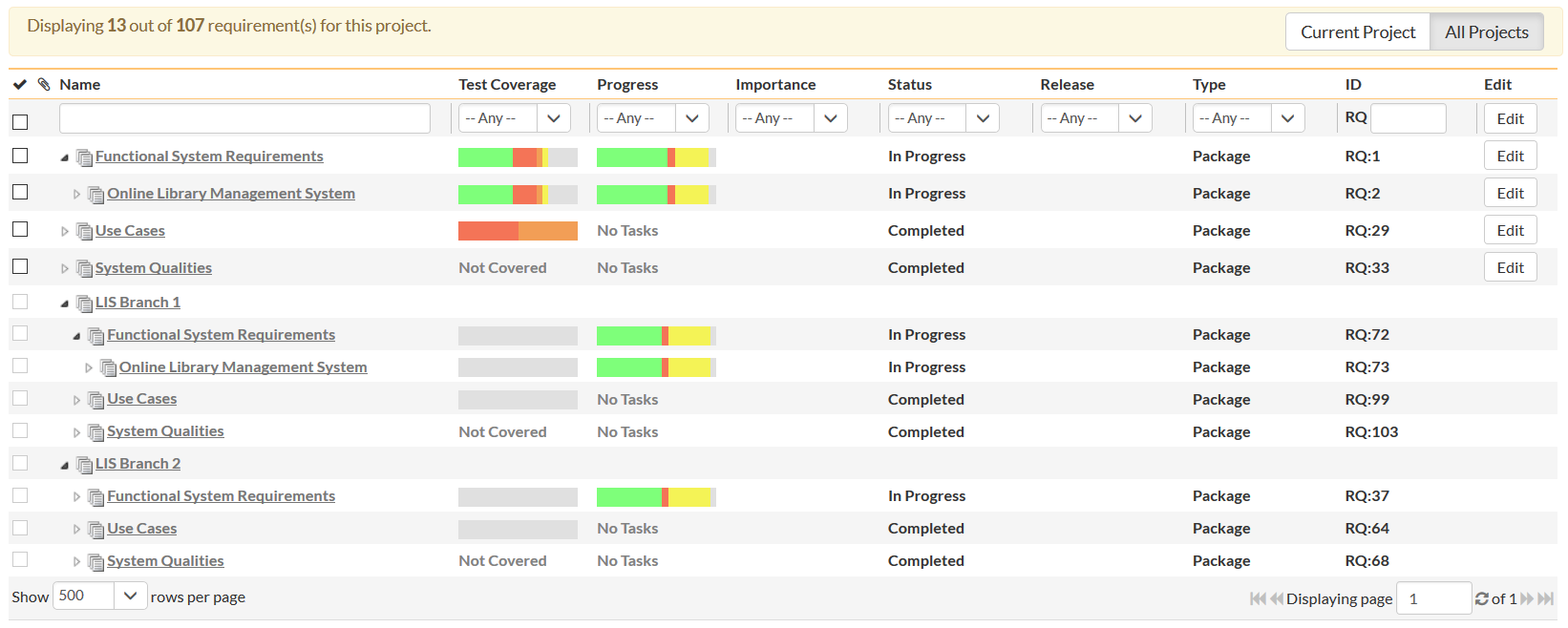

For these industries, it’s not uncommon to have to balance both specific system requirements and a larger set of mandated policies and regulations. In order to manage this complexity, it is essential to be able to define core mandated requirements that are shared across projects, while also accounting for project-specific features, use cases, and user stories.

SpiraTeam gives you the ability to share artifacts between projects. This powerful feature allows you to reuse components, features, and tests from other projects. In addition, you can share requirements between projects so that you can view all of them in a single list; including those from any component projects that are included:

Traceability

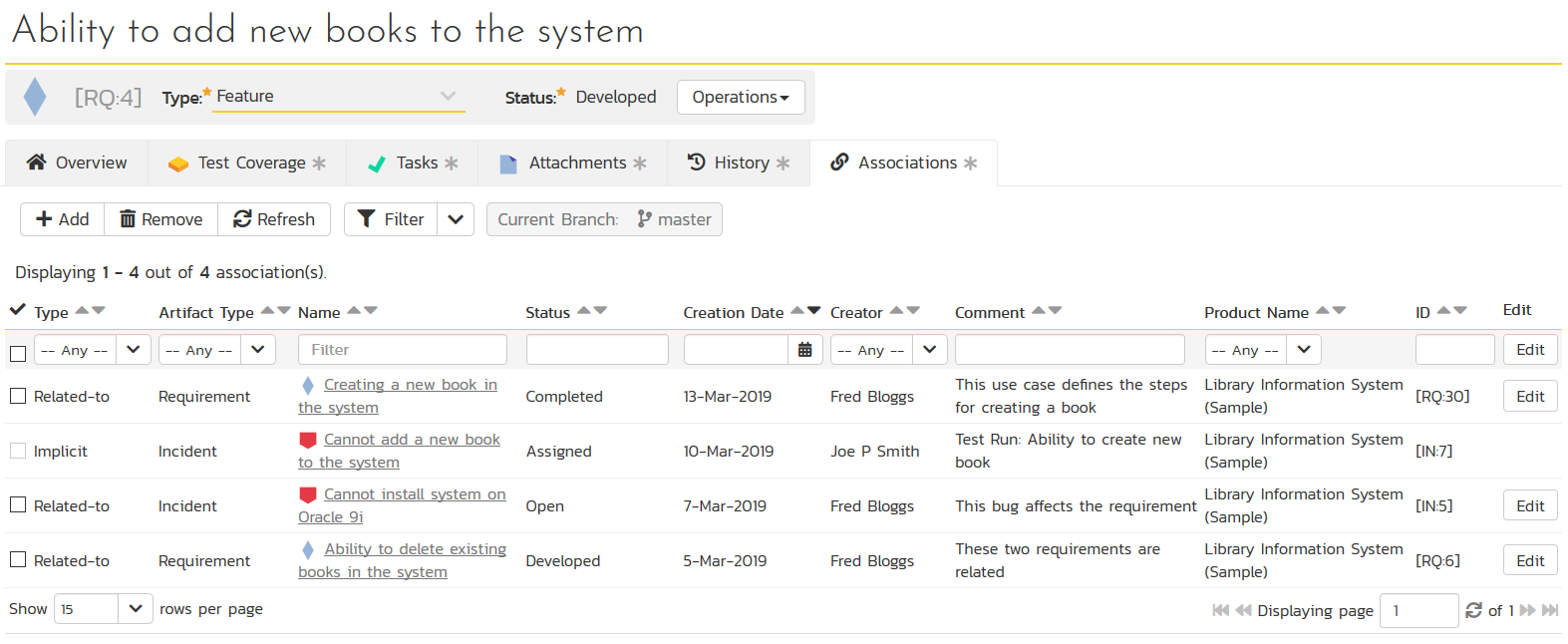

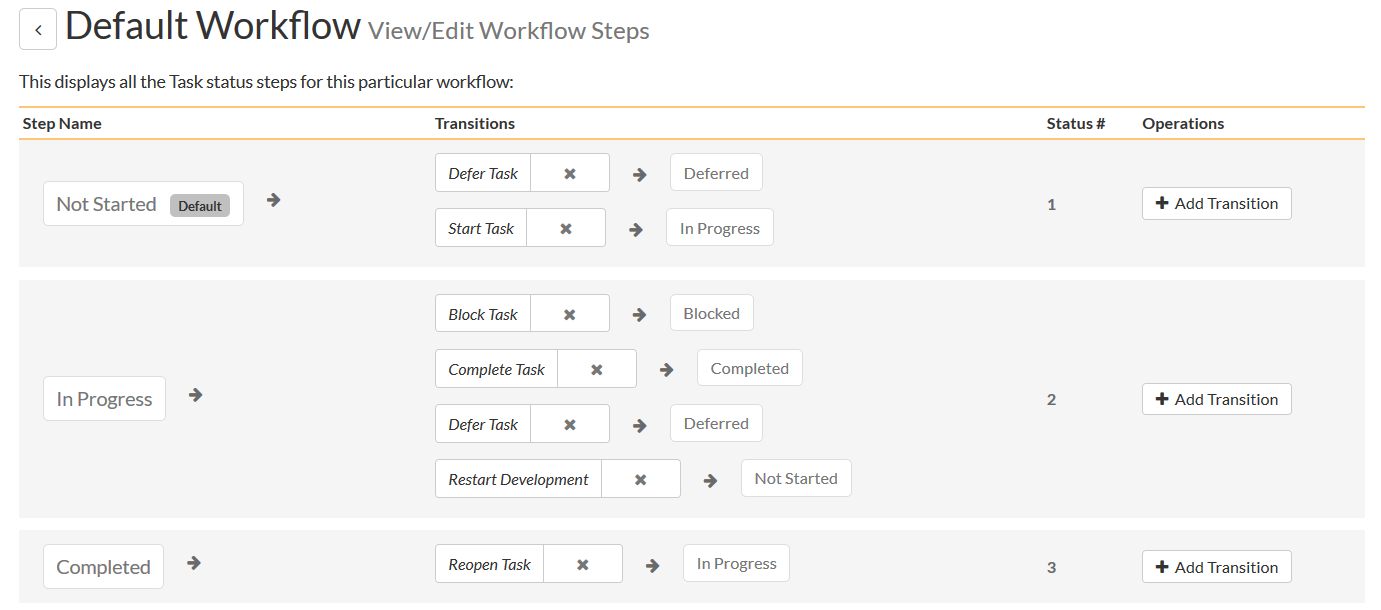

For banks and other finance firms, requirements traceability is not optional — all changes to core systems must be validated and managed in accordance with defined processes, procedures, roles, and regulations. This requires an Application Lifecycle Management (ALM) solution that provides optimal mapping between requirements, tasks, software controls, test controls, pre-production staging builds, and releases.

SpiraTeam again offers a comprehensive ALM solution that enables software development teams to manage the entire end-to-end process of developing and testing software in accordance with your defined procedures. It also simplifies reporting, making it easier for you to demonstrate the linkage between your policy attestations and the final code release.

Security & privacy

In the financial services industry, security breaches can have devastating consequences, with costs and regulatory damage that can literally "break the bank." To prevent this, you need the right tools in place for managing banking data, tracking security requirements, testing activities, and associated defects..

Securing the codebase is another crucial element to prevent security breaches and vulnerabilities. With SpiraPlan, you can easily see real-time traceability between each change in the codebase and the associated requirement, task, or defect that made the change necessary. This real-time traceability helps you find unauthorized code changes and prevent security vulnerabilities before they happen.

In addition, an ALM solution needs to provide sufficient security and privacy controls to ensure that your code data is secure and maintained with integrity. SpiraTeam is available both as an on-premise solution and as a secure cloud service, giving you multiple options to align with your security policies.

Transaction processing

In the financial industry, where transactions contain massive volumes of complex data, manual testing is no longer sufficient. To keep up with this demand, it’s imperative to automate your system testing. Our Rapise test automation platform is built from the ground up to address the unique challenges of testing desktop, web, and mobile financial applications. Now you can use the same tool to test the back-office systems and the mobile applications used by customers in the same set of transactions.

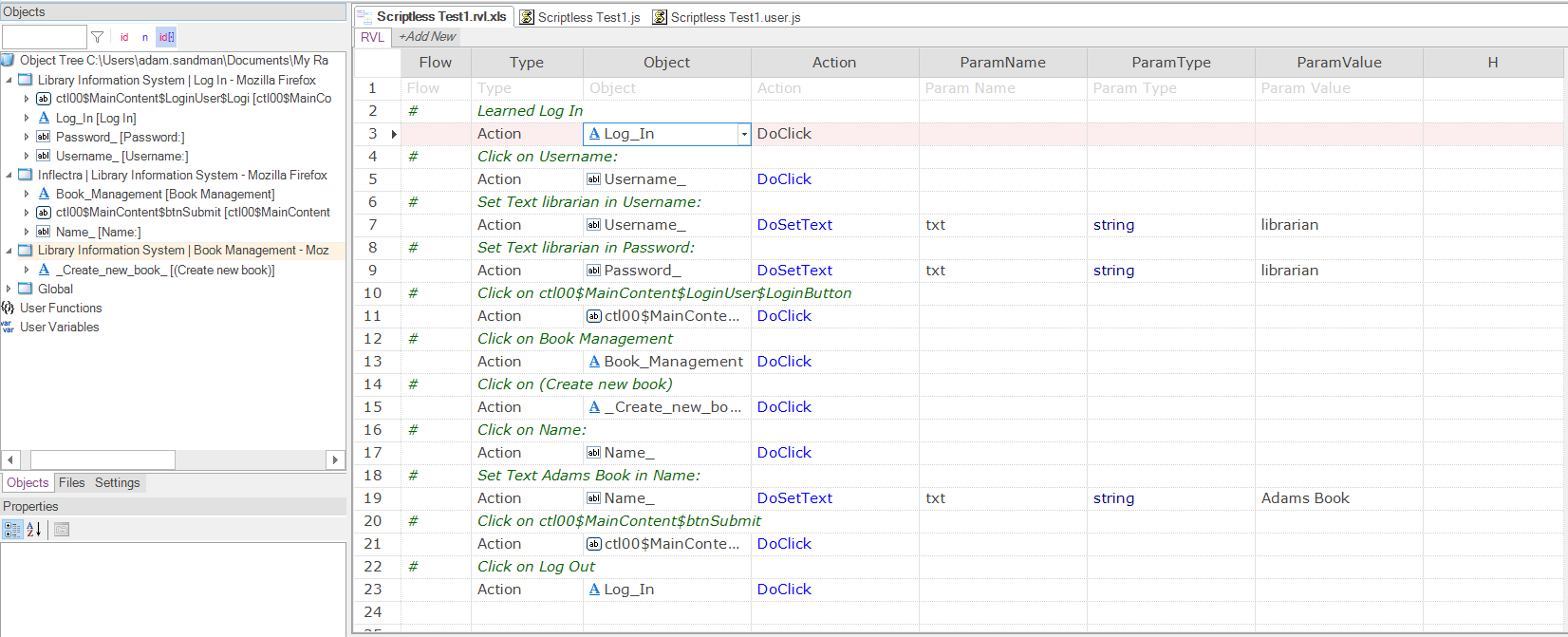

Rapise includes a data-driven and scriptless test design and execution language called Rapise Visual Language (RVL). This simplifies the process of creating large-scale regression tests, which allows you to test large volumes of complex transactional data against your core systems.

Complex algorithms

As the financial industry (and innovations like AI and ML) continues to evolve, high-speed trading and automated trading platforms have become more prevalent. You need complex algorithms and solutions that can handle large volumes of real-time data, but testing and validating those complex algorithms is also crucial.

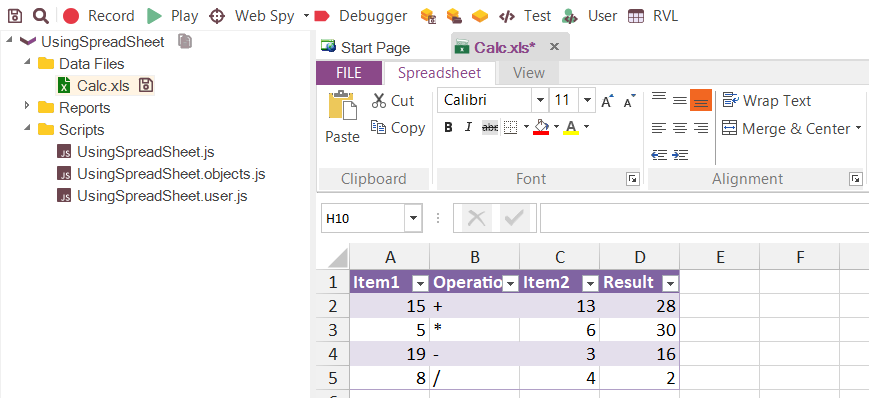

Our Rapise automated testing platform provides you with a system that can handle the load. With its powerful support for data-driven testing, built-in mathematical libraries, and easy extensibility, Rapise is an ideal solution for testing and validating complex algorithms used in high-speed and automated trading platforms.

Speed & agility

On the note of speed, financial software development requires this in both the development process, as well as the system’s performance. Financial software needs to be released at a fast pace and needs to work quickly, because trading in the financial markets is a race among competing firms.

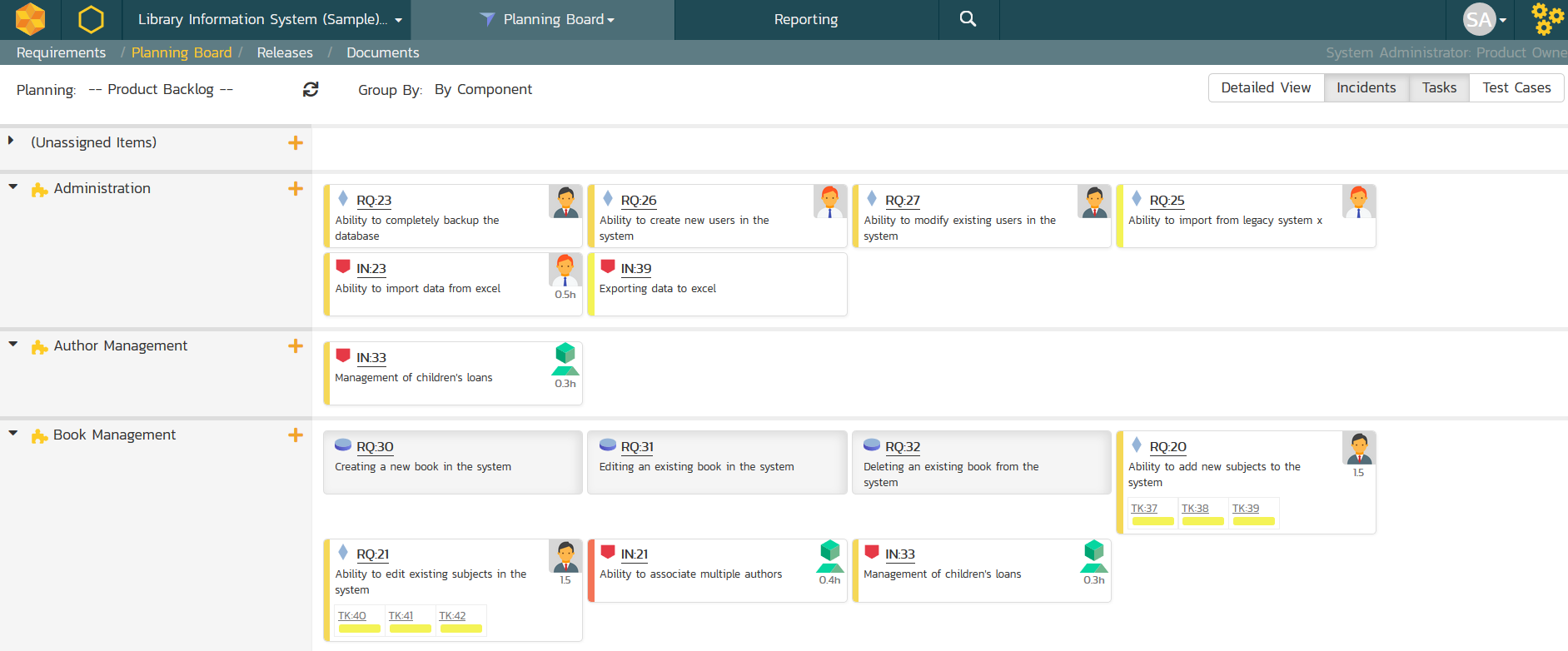

Our SpiraTeam application lifecycle management software has been designed for agile processes from day one. This provides a fluid and dynamic requirements management process that has real-time dashboards and visual planning boards to enable simultaneous collaborative planning and prioritization.

However, although banks and finance firms are heavy users of Agile methodologies and DevOps, the need to support regulatory reporting requirements necessitates companies to adapt and include additional steps and artifacts that are not strictly agile. To accomplish this, tools that are agile in nature, but provide flexibility to include waterfall steps, use cases, item dependencies, and other traditional needs are necessary.

SpiraTeam’s methodology-agnostic design allows for this flexibility that lets you work in a hybrid methodology tailored to your specific business needs.

Data interoperability

An important aspect of ALM tools that you need to consider is the ability to move data between systems and work with other platforms (data interoperability). For European companies, the General Data Protection Regulation (GDPR) mandates this functionality. Therefore, it's important to ensure that your ALM platform has a strong set of versioned APIs that are actively maintained and developed. These APIs will allow you to integrate data from your ALM solution with other systems, such as billing, document management, and more.

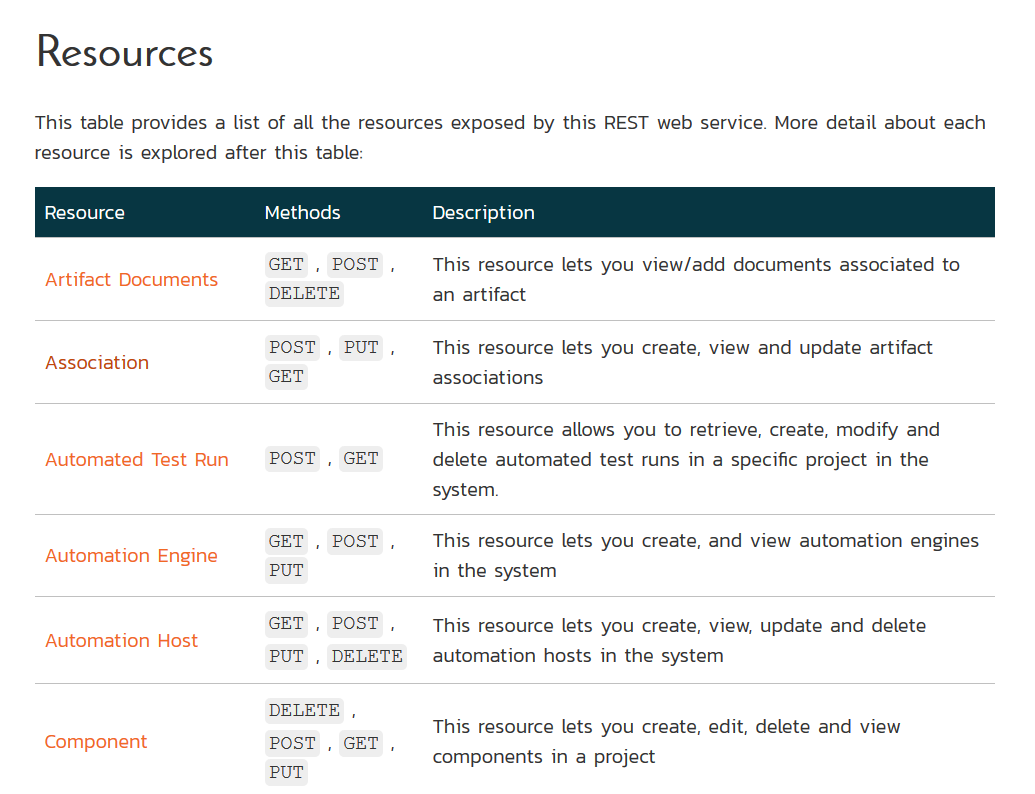

SpiraTeam offers a robust set of REST and SOAP APIs that are versioned and maintained, and can seamlessly run code written over a decade ago against the current version, without needing to make any changes.

Overcome these challenges with Spira

Software development and testing for the financial and banking industries requires a deep understanding of the unique challenges and considerations involved in this complex field. With the right tools and processes in place, developers and testers can navigate these challenges and create reliable and secure software that meets the needs of the industry.

At Inflectra, we understand the importance of quality and compliance in financial software development, which is why we offer powerful software testing and project management tools like SpiraTest, SpiraTeam, and SpiraPlan. These tools are specifically designed to help software development teams achieve their goals efficiently and effectively, and to help ensure that their software meets the rigorous requirements of the financial industry. Learn more about these platforms and how they can help your software development team, or start a free trial today!